Global Credit Card processing solution you must have

Choosing KipMotion means partnering with a leader in the payment processing industry that is committed to helping your business thrive. With cutting-edge technology, seamless integration, top-tier security, global reach, and customizable solutions, KipMotion offers everything you need to deliver a superior payment experience to your customers. Make the smart choice today and take your business to the next level with KipMotion.

Join nowstarts here!

Maximize transaction success with intelligent payment routing!

KipMotion guarantees secure and fast transactions!

Join us and experience payments at the speed of motion

About KipMotion

Start expanding your financial frontier

At KipMotion, we move money at the speed of business. Built for efficiency, security, and seamless transactions, our cutting-edge credit card processing solutions empower businesses to accept payments instantly-anytime, anywhere.

20x

Speed That Drives Business

Time is money, and with KipMotion, your payments move faster than ever. Our advanced processing technology ensures near-instant transactions, so you can keep your business running without delays. From point-of-sale purchases to online checkouts, we make every payment swift and effortless.

100%

Secure Payments, Every Time

Security is at the heart of everything we do. With industry-leading encryption, tokenization, and fraud prevention, KipMotion safeguards every transaction. Your customers’ data stays protected, and your business remains compliant with the latest security standards.

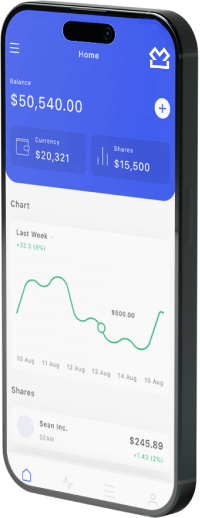

One app for all

Secure payment

Trusted by industry leading companies around the globe

Your Success, Our Motion

The Power of Uninterrupted Transactions

At KipMotion, we don’t just process payments, we accelerate growth. Whether you’re a small business or an enterprise, we keep your cash flow in motion, so you can focus on what matters most building your business.

Join us and experience payments at the speed of motion.

info@kipmotion.com

Phone

Lightning-Fast Processing

Reduce wait times and get paid faster.

Real-Time Fund Movement

Access your funds without unnecessary delays.

Ironclad Security

Advanced fraud detection and data protection at every step.

Effortless Integration

Works with your existing systems for a hassle-free setup.

Countless

Transactions

Trusted and valued

by our clients

more features

What KipMotion provides

KipMotion is more of a mindset than technology or industry, our product is designed by industry veterans to solve these problems. It will save you time, money, and heartache

Open a Merchant Account in Just a Few Clicks

Setting up a merchant account has never been easier. With KipMotion, you can start accepting payments quickly and securely, without unnecessary delays or paperwork. Our seamless onboarding process ensures that your business is ready to process transactions in no time.

Recurring Payments

At KipMotion, we specialize in providing secure and efficient payment processing solutions tailored to businesses embracing the subscription economy. Our advanced payment infrastructure ensures seamless transaction processing, fraud prevention, and flexible billing options, helping businesses scale with confidence.

Cooperation without Borders

Expand your business globally with KipMotion’s seamless credit card processing solutions. Our platform enables businesses to accept payments from customers in multiple countries, ensuring secure and reliable transactions across various regions.

3-D Secure Authorization: Enhanced Security for Online Payments

Protect your business and customers with 3-D Secure authorization, an extra layer of security for online transactions. This authentication protocol helps prevent fraudulent activities by requiring additional customer verification during payment processing.

Best 24/7 Support Services – You Are in Safe Hands

At KipMotion, we understand that reliable support is crucial for seamless payment processing. Our dedicated 24/7 support team is always available to assist you with any inquiries, technical issues, or urgent matters, ensuring uninterrupted service for your business. Trust KipMotion’s best-in-class 24/7 support services to keep your transactions secure and operations smooth. We’ve got you covered!

Exclusive Anjouan Gaming License Offer!

Fast Approval – Obtain your license in just one month

Affordable Costs – One of the cheapest licenses in the market

Crypto-Friendly – Accept payments in fiat & crypto

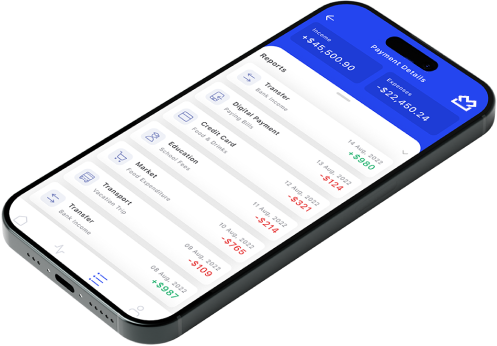

Payments processing

What makes our services stand out from the rest

OUR HAPPY PARTNERS

Join companies who already trust us

Choosing KipMotion means partnering with a leader in the payment processing industry that is committed to helping your business thrive. With cutting-edge technology, seamless integration, top-tier security, global reach, and customizable solutions, KipMotion offers everything you need to deliver superior payment experience to your customers. Make the smart choice today and take your business to the next level with KipMotion.

Join us

Become an Agent 💳🚀

Looking for a rewarding opportunity in the payment industry? Join KipMotion as an agent and unlock limitless earning potential!

High Commission Rates

Cutting-Edge Payment Solutions

Full Support & Reports

Grow Your Own Network

As a KipMotion agent, you’ll enjoy unparalleled benefits. From earning high commissions to accessing the latest payment technologies, you will have everything you need to succeed. KipMotion provides comprehensive support and training, ensuring you are well-equipped to grow your network and expand your business. Furthermore, you will have the chance to play a crucial role in helping businesses optimize their payment processes, making a tangible impact while reaping substantial rewards.

Help businesses streamline their transactions and get rewarded for it! 💼💰

Opening Merchant Account

Power Your Business with a Secure & Reliable Merchant Account!

Open your Merchant Account today and unlock seamless, secure, and reliable payment processing. Grow your business with fast transactions and full support

Create Your Account

Sign up in minutes and start growing your business!

Fill in an Application Form

Complete your application quickly and start accepting payments with us. Secure, reliable, and built for your business!

01

Start Processing Your Payments

Start processing payments seamlessly-fast, secure, and hassle-free.

02

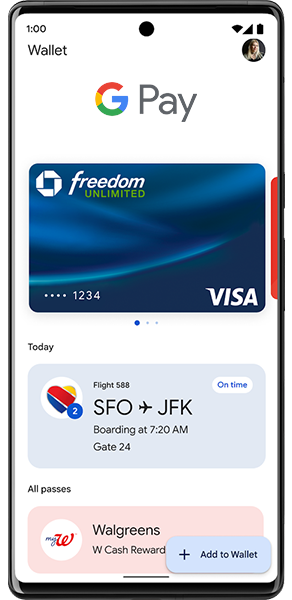

Google Pay

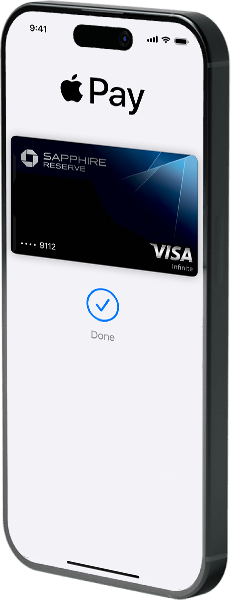

Apple pay

Revolutionizing Card Processing with KipMotion

Mobile wallets like Google Pay and Apple Pay are changing the way we make payments, offering speed, security, and convenience. At KipMotion, we recognize the importance of these platforms and help businesses integrate them effortlessly into their payment systems.

Both Google Pay and Apple Pay use advanced technology like tokenization and biometric authentication to provide secure, frictionless transactions. As more consumers embrace mobile payments, offering these options is crucial for staying competitive.

KipMotion simplifies the integration of Google Pay and Apple Pay, ensuring smooth and reliable transactions. With us, you’re not just keeping up with the future of payments—you’re leading the way.

Ready to offer a better, more secure payment experience? Let KipMotion help you get there.

Frequently Asked Questions (FAQ) in Card Processing

What is card processing?

Card processing is the mechanism that allows businesses to accept payments from customers using credit or debit cards. It involves the authorization, clearing, and settlement of card transactions.

How does card processing work?

When a customer uses a card to make a purchase, the card information is transmitted to the merchant’s payment processor. The processor then communicates with the cardholder’s bank to verify the transaction and ensure there are sufficient funds. If approved, the transaction is completed, and the funds are transferred to the merchant’s account.

What is a payment gateway?

A payment gateway is a service that authorizes credit card or direct payments for online businesses. It acts as the intermediary between the merchant’s website and the bank, ensuring that the transaction information is securely transmitted.

What fees are involved in card processing?

Card processing typically involves several fees, including transaction fees, monthly fees, and chargeback fees. Transaction fees are a percentage of each sale plus a fixed amount. Monthly fees cover the cost of maintaining the processing service, while chargeback fees are incurred when a customer disputes a transaction.

How do I choose a card processing provider?

When selecting a card processing provider, consider factors such as the provider’s reputation, fee structure, security measures, customer support, and the range of services offered. It’s essential to compare different providers to find the one that best suits your business needs.

What is a chargeback?

A chargeback occurs when a cardholder disputes a transaction and requests a refund from their bank. This can happen for various reasons, such as fraud, billing errors, or dissatisfaction with the purchased goods or services. Chargebacks can result in additional fees for the merchant.

How can I prevent chargebacks?

To prevent chargebacks, ensure that your transaction processes are secure, provide clear and accurate product descriptions, offer excellent customer service, and respond promptly to any customer inquiries or disputes. Additionally, implementing fraud prevention tools can help reduce the risk of fraudulent transactions.

What is PCI compliance?

PCI compliance refers to the Payment Card Industry Data Security Standard (PCI DSS), a set of security standards designed to protect cardholder information. Businesses that process, store, or transmit card data must comply with these standards to ensure the security of their transactions.

How can I achieve PCI compliance?

To achieve PCI compliance, businesses must follow the requirements outlined in the PCI DSS. This includes maintaining a secure network, protecting cardholder data, implementing strong access control measures, regularly monitoring and testing networks, and maintaining an information security policy. Working with a PCI-compliant card processing provider can also help ensure that your business meets these standards.

What should I do if I suspect fraud?

If you suspect fraud, it’s crucial to act quickly. Contact your card processing provider immediately to report the suspicious activity and follow their instructions. Additionally, review your security measures to identify any potential vulnerabilities and take steps to address them.

Can I process international transactions?

Yes, many card processing providers offer the ability to process international transactions. However, it’s essential to verify whether your provider supports this feature and to understand any additional fees or requirements associated with international processing.

What types of cards can I accept?

The types of cards you can accept depend on your card processing provider. Most providers support major credit and debit card brands, such as Visa, MasterCard, American Express, and Discover. Some providers may also support additional payment methods, such as digital wallets and mobile payments.

How long does it take for funds to be deposited into my account?

The time it takes for funds to be deposited into your account can vary depending on your card processing provider and the specific terms of your agreement. Typically, funds are deposited within 24 to 48 hours after the transaction is processed.

What is a virtual terminal?

A virtual terminal is an online application that allows merchants to process card transactions without the need for a physical card reader. Merchants can manually enter the card details into the virtual terminal to complete the transaction, making it ideal for phone or mail orders.

How secure is card processing?

Card processing is generally secure, especially when using a reputable provider that complies with PCI DSS standards. Providers use encryption, tokenization, and other security measures to protect cardholder data and prevent unauthorized access. However, it’s essential for merchants to also implement their own security measures to ensure the safety of their transactions.